Are you an entrepreneur, solo business owner or freelancer? Are you keen to get regular business advice but don’t have the time to work out which blogs to subscribe to? Well, we’ve done the research for you.

Here’s a collection of business blogs aimed at entrepreneurs and small businesses. These have been chosen for their insights, advice, presentation and overall appeal to business people. Hopefully you’ll find these blogs cover all the business management advice and business trends analysis for your needs.

1. Harvard Business Review

Harvard Business Review is a staple in any entrepreneur blog collection. The blog delivers timely business analysis and professional management advice.

2. Young Entrepreneur

When you’re just starting our with your business venture, things can be a little tough. Young Entrepreneur focuses on the things you’ll need to know – financing, bootstrapping, identifying opportunities and making sales.

3. 64 Notes

64 Notes gets straight to the nuggets of gold by bypassing straightforward management tips and filling each post with those eye-opening things that change your business from alright to amazing. They also write a lot about how to avoid being the start-up that failed.

4. The Personal MBA

The Personal MBA is a blog dedicated to teaching all the tips and tricks you would have learned if you had done a degree in business. It recommends books, summarises books and draws on advice given freely by great minds in business. If you follow this blog you will learn a great deal about managing your business.

5. Instigator Blog

Instigator Blog is a very insightful blog, mainly discussing thoughts relevant to small business and entrepreneurs, written by an entrepreneur as he works on his business.

6. Fast Company

Fast Company is a major business blog, covering business news and trends. It’s vital information if you want to know where business is heading.

7. Entrepreneur Blog

Entrepreneur Blog is a site dedicated to providing business insights to entrepreneurs. It will analyse business failures, successes and trends, while offering sensible advice for any business owner.

8. The Entrepreneurial Mind

The Entrepreneurial Mind is a business blog written by a Belmont University professor of Entrepreneurship. His academic insight into the world of the entrepreneur is a great balance to the news and trends offered by other blogs.

9. Creative Web Biz

Creative Web Biz is a great blog for all the artistic entrepreneurs out there. This is a place for those people who are entrepreneurs, but don’t much care for all the business management advice and trends. This blog is entirely focused on how to get that art out there and sold. Highly recommended for musicians, artists, and makers of other crafts.

10. Work Happy

Work Happy is a blog offering advice for anyone in business for themselves. It’s useful for freelancers, small business owners and entrepreneurs alike. It features a lot of video presentations from entrepreneurs to keep things interesting.

Bonus: Entrepreneurship Interviews

Entrepreneurship Interviews added itself on to the list by being a wealth of information in the form of interviews with entrepreneurs. It’s not much to look at, but there is a lot to be gained by listening to what other entrepreneurs say candidly about their own business ventures.

More Blogs

If you’re keen to see some more great blog lists from MakeUseOf, read on:

- Four Best Inspiring Blogs Every Life Hacker Should Subscribe To

- 3 Personal Finance Blogs That Will Get You Out Of Debt

- The 10 Most Stunning Photo Blogs

- 6 Best Web Design Blogs To Follow

- The 6 Best Blogs For Architectural & Interior Design Ideas

If you know of other great blogs for business people, let us know in the comments!

Image Credit: Shutterstock

In the digital age, nobody likes carrying a lot of cash around – I know I don’t, anyway. This can be especially frustrating when you go to keep track of your expenses, who you owe money to, who you lent some to and just where it all goes over the month.

As always, there are a lot of apps out there to help you do various things with your money. There are apps to figure out how to manage your money, oversee expenses, send money to people, keep track of who owes you, and more.

In this article, I’ll show you some of the applications you can take advantage of to do everything I’ve mentioned here, leaving you free to pick and choose the apps that will make your life easier.

How to Manage Your Money

I’m beginning to learn just how difficult managing your expenses can be. For the most part, I use my debit card tied to my checking account to make purchases. I use it at the grocery store, when I go out to lunch with my coworkers and on the weekend when I’m out exploring the city.

At the end of the month, my bank statement looks pretty ridiculous. All of these small transactions make it difficult to sift through. I still know what everything is, but if I wanted to see where I could be saving some money I wouldn’t know the first place to look.

Sounds like you? Even if it doesn’t, you could still reap the benefits of visually being able to manage your money. These apps make the process a lot easier.

Mint

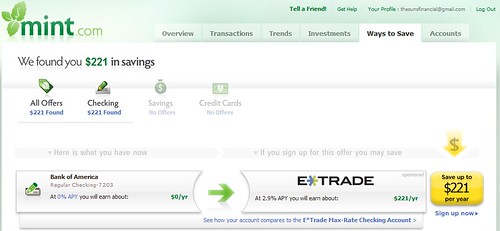

Mint has been on our radar since back in 2007 when Karl wrote about it. Plain and simple, if there is one app I want you to keep in mind it’s this one.

Mint is a free personal finance application that can help you compare your bank accounts, credit cards, CDs, brokerage and 401(k) to the best products out there. It offers a visual representation of your finances and is very easy to set up. Use it to manage your budget, get credit card advice and understand investing.

Here’s a great video showcasing an overview of Mint’s features:

For some helpful tips on how to use Mint, check out Bakari’s article on How To Use Mint To Manage Your Budget & Spendings Online.

Thrive

Thrive (directory app) is also a great application if you’re looking for a simple way to keep track of your spending. With Thrive, you get an overall Financial Health score, which is one number that shows you how financially fit you are. It also shows you scores in other areas and offers you advice on how to make improvements.

Thrive breaks down your spending for you and shows you where you can save. Compare your current budget to last month’s, as well as view a six month average and target budgets to follow.

Texthog

Looking for an even simpler way to track expenses? Texthog (directory app) lets you easily store, organize and access your receipts, expense reports and more via text message, the web, your email, iPhone and even Twitter.

A Texthog free account gives one user the ability to track expenses, view unlimited reports and get budget/bill reminders. Take a photo of your receipts and utilize tags and categories to keep track of everything.

To check out Texthog on your iPhone, you can find the application on iTunes.

Venmo

Speaking of text messages, have you heard of Venmo? Venmo (directory app) is a nice little app that lets you pay and charge friends with your phone. Send and receive secure payments by linking your card to your account. This allows you to settle small loans you give/get by eliminating paper transactions for small amounts of money.

To use Venmo, all you do is create an account. You can then send and receive money to other accounts simply by using text commands in SMS. Accept a “trust” request from your friends and make transactions without having to authorize them by texting a 3 digit code.

This is a pretty solid application that I have been using a lot lately with my friends/coworkers. It’s great for when a bunch of you are out to lunch and not everyone has cash on them. “I’ll just put it on my card and Venmo you all afterwards.”

Owe Me Cash

Owe Me Cash is a nice app I found recently that is also very easy to use. If someone owes you money, you just sign into Owe Me Cash with your Twitter, Facebook, OpenID, or regular account and tell the app about the debt. The app will send automatic reminders to those that owe you money by phone, text and email, so you can get paid!

This app is more fun than serious, but it doubles as an easy way to keep track of who owes you what. Let the app bug your friends to pay you so you don’t have to do it yourself – it’s a win-win.

Conclusion

With these applications, your finances will never look better. Say goodbye to paper money and change.

What do you think of these money-managing applications? Will you be using any of them?

Image Credit: marema

alpine payment systems scam

<b>News</b> - Tixdaq

Foo Fighters have been confirmed to headline the final night at Isle Of Wight festival 2011.

More Bad <b>News</b> for Obama 2012: Catholics Elect Dolan - Swampland <b>...</b>

Corrected Nov. 17: The Catholic bishops' surprise election yesterday of New York's Archbishop Timothy M. Dolan as their president is more bad news for Obama in 2012.

Lujiazui Breakfast: <b>News</b> And Views About China Stocks (Nov. 18 <b>...</b>

Investors and traders in China's main financial district are talking about the following before the start of trade today: Shanghai's main stock index fell 1.9% yesterday amid concerns about the impact of government efforts to slow down ...

<b>News</b> - Tixdaq

Foo Fighters have been confirmed to headline the final night at Isle Of Wight festival 2011.

More Bad <b>News</b> for Obama 2012: Catholics Elect Dolan - Swampland <b>...</b>

Corrected Nov. 17: The Catholic bishops' surprise election yesterday of New York's Archbishop Timothy M. Dolan as their president is more bad news for Obama in 2012.

Lujiazui Breakfast: <b>News</b> And Views About China Stocks (Nov. 18 <b>...</b>

Investors and traders in China's main financial district are talking about the following before the start of trade today: Shanghai's main stock index fell 1.9% yesterday amid concerns about the impact of government efforts to slow down ...

alpine payment systems scam

<b>News</b> - Tixdaq

Foo Fighters have been confirmed to headline the final night at Isle Of Wight festival 2011.

More Bad <b>News</b> for Obama 2012: Catholics Elect Dolan - Swampland <b>...</b>

Corrected Nov. 17: The Catholic bishops' surprise election yesterday of New York's Archbishop Timothy M. Dolan as their president is more bad news for Obama in 2012.

Lujiazui Breakfast: <b>News</b> And Views About China Stocks (Nov. 18 <b>...</b>

Investors and traders in China's main financial district are talking about the following before the start of trade today: Shanghai's main stock index fell 1.9% yesterday amid concerns about the impact of government efforts to slow down ...