photo: Ben Atkin

According to Techcrunch, since the iPad’s release in April the number of iPad apps has grown to over 10,000. That is still dwarfed by the iPhone’s library of 200,000 apps — and growing — but is still pretty impressive for just a few months on the market.

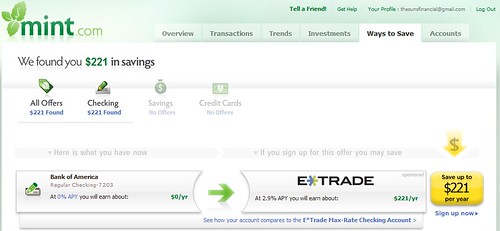

Since the iPad is still in its infant stages, the app store is relatively light on apps with a specific personal finance focus: most still focus on the gaming and reading niches. (Apple, however, says that almost all of its 200,000 iPhone apps are compatible with the iPad, including the Mint.com mobile app. You could also revisit Mint’s list of the top personal finance apps, published back in February. Alternatively, take a look at Apple’s list of money management iPhone apps.)

Still, we were recently able to find seven iPad apps that, if not directly related to personal finance management, at the very least help you find savings in everyday life situations and, as a result, manage your money more successfully.

Staying true to the Mint money-saving spirit, all but one of the apps are free to download (the other costs only $1.99), and none require a subscription.

Zillow – Free

Zillow has established itself as a great starting point for anyone interested in buying or selling a home. You can search by city or zip, find all homes for sale in the area of your interest, as well as comparable home sales. Once you’ve found a home you’re interested in, you can check out what that home sold for in the past and its estimated value, or “Zestimate.” Why does it make a great mobile app? Because it enables you to take your home search on the road with you: once you hunt down homes you are interested in, you can see them in person, and then take a peak at photos taken from inside the home.

Epicurious – Free

The iPad app from Epicurious.com includes over 28,000 tested recipes from magazines such as Bon Appétit and Gourmet, popular cookbooks, top chefs, and leading restaurants. And the iPad size makes it a great fit as a digital cookbook. What makes it a great personal finance app? Cooking at home is a much cheaper and healthier alternative to eating out!

Grocery IQ – Free

GroceryIQ is a mobile app that allows you to make grocery lists, sync and share them with others (so both you and your significant other don’t come home with a gallon of sauerkraut on the same night), scan barcodes, and even find and send coupons right to your loyalty card. Having a consistent grocery list for each store you shop at is a fail-safe way to keep your grocery expenses down.

Bloomberg – Free

If you like keeping up with your portfolio and business news throughout the day, Bloomberg offers a great iPad app to help you do so. The app offers customized news, stock quotes, company descriptions, market leaders/laggers, price charts, market trends analysis, and more.

Trapster – Free

Trapster has over 7 million users who provide information on speed traps, video enforced speed zones, and police check points. Now, we’re not saying you should recklessly speed around with your Trapster app spitting warnings at you. But most of us have been caught slightly over the speed limit at times, just because we weren’t familiar enough with a given area to be on our guard. Just don’t get caught paying too much attention to Trapster while you’re driving around (that kind of defeats the purpose of the app).

Kayak – Free

The Kayak iPad app, in itself, doesn’t offer any groundbreaking new functionality above the iPhone app or Kayak website. However, Kayak offers such a great airfare comparison interface and with the vibrant large-screen iPad display, it packs even more punch onto one screen.

Compoundee HD – Compound Interest Calculator – $1.99

Compoundee HD is a basic, easy-to-use financial calculator that is able to calculate 5 different investment variables on compound interest calculations at a daily, weekly, quarterly, semi-annual, or annual level. You can find out how much an investment will be worth over a period of time and the calculation over email. This app could be extremely useful for real-estate agents and brokers, bankers, and mortgage brokers.

Which iPad personal finance apps make your “best of” list?

GE Miller discusses personal finance topics for young professionals at 20somethingfinance.com.

Apparently controlling the Federal Reserve, funding their bonuses with billions in taxpayer dollars and quite nearly bringing down the global economy with their degenerate gambling habits isn’t enough.

Wall Street now wants to punish any Democrat who lifts a hand against them, and they’re willing to fund primary challenges to do it.

Carolyn Maloney worked to push through the Credit Card Holder’s Bill of Rights, which may not have gone far enough to limit the ability of Wall Street robber barons to gouge credit card holders. But it will cost the credit card industry about $10 billion a year, and that was apparently a bridge too far for Steve Rattner, Orrin Kramer, Maureen White and other Democratic party oligarchs who are now funding hedge fund darling Reshma Saujani’s primary challenge as a way to punish Maloney for her transgressions.

From the Washington Post:

has worked at three hedge funds. She speaks the arcane language of derivatives and basis points and mortgage-backed securities. Saujani has positioned herself as the anti-Maloney, the only candidate who understands how stressful and difficult the past few years have been for some of the wealthiest people in America.

Poor dears. Yes, the Masters of the Universe are so very put upon in these hard times. It’s only right that they be allowed to have their own member of Congress, if they can afford one:

Since she entered the race in November, Saujani has received more than $800,000 in campaign contributions, an impressive tally for an untested candidate. Many of those checks came from New York financiers and their spouses.

Former Morgan Stanley chief executive John Mack has given her money. So has Apollo Management founder Leon Black and the wife of J.P. Morgan Chase chief executive Jamie Dimon. Hedge fund mogul Marc Lasry hosted a fundraiser for her featuring singer John Legend that brought in a clean $100,000.

She has also attracted help from prominent New Yorkers. Maureen White, a major Democratic donor and wife of financier Steven Rattner, is introducing her to potential donors. Diana Taylor, a Republican former investment banker and the longtime companion of Mayor Michael R. Bloomberg (I), is advising her campaign.

Maureen White, the former National Finance Chair of the DNC (who was able get a story about her DUI yanked out of the New York Times thanks to the close personal friendship between her husband Steve Rattner and Pinch Sulzberger), thinks that now is the right time to be publicly attacking the recently widowed Maloney for just not being quite sharp enough for the job:

Saujani’s supporters openly question Maloney’s fitness to serve and her intellectual heft. In an interview, White, the major Democratic donor, called Maloney “a good person.” But she said, “There’s a lot more to being a good representative: leadership, intelligence, hard work, a creative approach to policy, thinking things through.

“When you look at this district, it should have a star,” White added. “We need the best of the best, and I think Reshma is in that category in a way Carolyn isn’t.”

And why does White think Reshma’s got the intellectual ballast? Well, because Reshma understands that “the financial industry has been unfairly demonized in Congress”:

“Populism for the sake of populism, to increase poll numbers, is not helpful,” she said. “We need to have people in Washington who feel comfortable with understanding regulatory markets, economic terms. . . . I don’t think that she has practical real-world experience.”

Yes, that angry rabble who just don’t understand how Very Important our Wall Street Overlords are just need to STFU and graciously accept the leadership of someone like Reshma, whose glowing resume includes:

- Chief Operating Officer of a fund at Carret Asset Management, the hedge fund partially controlled by Hassan Nemazee, who recently pled guilty to running a Ponzi scheme that looted $292 million from banks to pay for a yacht, a Maserati and a Cesna, among other perks.

- Associate General Counsel for The Carlyle Group’s Blue Wave Partners Management, which invested in mortgage-backed securities. Unsurprisingly, Reshma doesn’t support current legislation to regulate derivatives trading.

- Deputy Chief Operating Officer of the Liquid Markets business at Fortress Investments, the hedge fund that owned a subprime mortgage lender that “foreclosed on New Orleans homeowners who fell behind on their payments after Hurricane Katrina.” Reshma says she was “unaware of the problem.”

Reshma has convinced the Right People that she’ll be there for them. Even Mike Bloomberg has blessed her, through his girlfriend Diana Taylor, quoted in the Washington Post article:

“Reshma has a strong fundamental understanding about how the industry works,” Taylor said. “You’ve got these people [in Congress] yelling and screaming who know nothing about what they’re talking about — nothing. And it just creates a huge problem.”

Oh yes, Congress and their “screaming and yelling” about Wall Street. They really have been terribly unfair to the poor banks. No wonder the Masters of the Universe feel they’re entitled to their own member of Congress to address this terrible injustice. And they’re writing the checks that fund her.

penis extender

photo: Ben Atkin

According to Techcrunch, since the iPad’s release in April the number of iPad apps has grown to over 10,000. That is still dwarfed by the iPhone’s library of 200,000 apps — and growing — but is still pretty impressive for just a few months on the market.

Since the iPad is still in its infant stages, the app store is relatively light on apps with a specific personal finance focus: most still focus on the gaming and reading niches. (Apple, however, says that almost all of its 200,000 iPhone apps are compatible with the iPad, including the Mint.com mobile app. You could also revisit Mint’s list of the top personal finance apps, published back in February. Alternatively, take a look at Apple’s list of money management iPhone apps.)

Still, we were recently able to find seven iPad apps that, if not directly related to personal finance management, at the very least help you find savings in everyday life situations and, as a result, manage your money more successfully.

Staying true to the Mint money-saving spirit, all but one of the apps are free to download (the other costs only $1.99), and none require a subscription.

Zillow – Free

Zillow has established itself as a great starting point for anyone interested in buying or selling a home. You can search by city or zip, find all homes for sale in the area of your interest, as well as comparable home sales. Once you’ve found a home you’re interested in, you can check out what that home sold for in the past and its estimated value, or “Zestimate.” Why does it make a great mobile app? Because it enables you to take your home search on the road with you: once you hunt down homes you are interested in, you can see them in person, and then take a peak at photos taken from inside the home.

Epicurious – Free

The iPad app from Epicurious.com includes over 28,000 tested recipes from magazines such as Bon Appétit and Gourmet, popular cookbooks, top chefs, and leading restaurants. And the iPad size makes it a great fit as a digital cookbook. What makes it a great personal finance app? Cooking at home is a much cheaper and healthier alternative to eating out!

Grocery IQ – Free

GroceryIQ is a mobile app that allows you to make grocery lists, sync and share them with others (so both you and your significant other don’t come home with a gallon of sauerkraut on the same night), scan barcodes, and even find and send coupons right to your loyalty card. Having a consistent grocery list for each store you shop at is a fail-safe way to keep your grocery expenses down.

Bloomberg – Free

If you like keeping up with your portfolio and business news throughout the day, Bloomberg offers a great iPad app to help you do so. The app offers customized news, stock quotes, company descriptions, market leaders/laggers, price charts, market trends analysis, and more.

Trapster – Free

Trapster has over 7 million users who provide information on speed traps, video enforced speed zones, and police check points. Now, we’re not saying you should recklessly speed around with your Trapster app spitting warnings at you. But most of us have been caught slightly over the speed limit at times, just because we weren’t familiar enough with a given area to be on our guard. Just don’t get caught paying too much attention to Trapster while you’re driving around (that kind of defeats the purpose of the app).

Kayak – Free

The Kayak iPad app, in itself, doesn’t offer any groundbreaking new functionality above the iPhone app or Kayak website. However, Kayak offers such a great airfare comparison interface and with the vibrant large-screen iPad display, it packs even more punch onto one screen.

Compoundee HD – Compound Interest Calculator – $1.99

Compoundee HD is a basic, easy-to-use financial calculator that is able to calculate 5 different investment variables on compound interest calculations at a daily, weekly, quarterly, semi-annual, or annual level. You can find out how much an investment will be worth over a period of time and the calculation over email. This app could be extremely useful for real-estate agents and brokers, bankers, and mortgage brokers.

Which iPad personal finance apps make your “best of” list?

GE Miller discusses personal finance topics for young professionals at 20somethingfinance.com.

Apparently controlling the Federal Reserve, funding their bonuses with billions in taxpayer dollars and quite nearly bringing down the global economy with their degenerate gambling habits isn’t enough.

Wall Street now wants to punish any Democrat who lifts a hand against them, and they’re willing to fund primary challenges to do it.

Carolyn Maloney worked to push through the Credit Card Holder’s Bill of Rights, which may not have gone far enough to limit the ability of Wall Street robber barons to gouge credit card holders. But it will cost the credit card industry about $10 billion a year, and that was apparently a bridge too far for Steve Rattner, Orrin Kramer, Maureen White and other Democratic party oligarchs who are now funding hedge fund darling Reshma Saujani’s primary challenge as a way to punish Maloney for her transgressions.

From the Washington Post:

has worked at three hedge funds. She speaks the arcane language of derivatives and basis points and mortgage-backed securities. Saujani has positioned herself as the anti-Maloney, the only candidate who understands how stressful and difficult the past few years have been for some of the wealthiest people in America.

Poor dears. Yes, the Masters of the Universe are so very put upon in these hard times. It’s only right that they be allowed to have their own member of Congress, if they can afford one:

Since she entered the race in November, Saujani has received more than $800,000 in campaign contributions, an impressive tally for an untested candidate. Many of those checks came from New York financiers and their spouses.

Former Morgan Stanley chief executive John Mack has given her money. So has Apollo Management founder Leon Black and the wife of J.P. Morgan Chase chief executive Jamie Dimon. Hedge fund mogul Marc Lasry hosted a fundraiser for her featuring singer John Legend that brought in a clean $100,000.

She has also attracted help from prominent New Yorkers. Maureen White, a major Democratic donor and wife of financier Steven Rattner, is introducing her to potential donors. Diana Taylor, a Republican former investment banker and the longtime companion of Mayor Michael R. Bloomberg (I), is advising her campaign.

Maureen White, the former National Finance Chair of the DNC (who was able get a story about her DUI yanked out of the New York Times thanks to the close personal friendship between her husband Steve Rattner and Pinch Sulzberger), thinks that now is the right time to be publicly attacking the recently widowed Maloney for just not being quite sharp enough for the job:

Saujani’s supporters openly question Maloney’s fitness to serve and her intellectual heft. In an interview, White, the major Democratic donor, called Maloney “a good person.” But she said, “There’s a lot more to being a good representative: leadership, intelligence, hard work, a creative approach to policy, thinking things through.

“When you look at this district, it should have a star,” White added. “We need the best of the best, and I think Reshma is in that category in a way Carolyn isn’t.”

And why does White think Reshma’s got the intellectual ballast? Well, because Reshma understands that “the financial industry has been unfairly demonized in Congress”:

“Populism for the sake of populism, to increase poll numbers, is not helpful,” she said. “We need to have people in Washington who feel comfortable with understanding regulatory markets, economic terms. . . . I don’t think that she has practical real-world experience.”

Yes, that angry rabble who just don’t understand how Very Important our Wall Street Overlords are just need to STFU and graciously accept the leadership of someone like Reshma, whose glowing resume includes:

- Chief Operating Officer of a fund at Carret Asset Management, the hedge fund partially controlled by Hassan Nemazee, who recently pled guilty to running a Ponzi scheme that looted $292 million from banks to pay for a yacht, a Maserati and a Cesna, among other perks.

- Associate General Counsel for The Carlyle Group’s Blue Wave Partners Management, which invested in mortgage-backed securities. Unsurprisingly, Reshma doesn’t support current legislation to regulate derivatives trading.

- Deputy Chief Operating Officer of the Liquid Markets business at Fortress Investments, the hedge fund that owned a subprime mortgage lender that “foreclosed on New Orleans homeowners who fell behind on their payments after Hurricane Katrina.” Reshma says she was “unaware of the problem.”

Reshma has convinced the Right People that she’ll be there for them. Even Mike Bloomberg has blessed her, through his girlfriend Diana Taylor, quoted in the Washington Post article:

“Reshma has a strong fundamental understanding about how the industry works,” Taylor said. “You’ve got these people [in Congress] yelling and screaming who know nothing about what they’re talking about — nothing. And it just creates a huge problem.”

Oh yes, Congress and their “screaming and yelling” about Wall Street. They really have been terribly unfair to the poor banks. No wonder the Masters of the Universe feel they’re entitled to their own member of Congress to address this terrible injustice. And they’re writing the checks that fund her.

online stock trading online stock trading how to lose weight fast

Guitar Hero: Warriors of Rock dated <b>News</b> - Page 1 | Eurogamer.net

Read our news of Guitar Hero: Warriors of Rock dated.

NFL Training Camp <b>News</b>: MRI Shows No Damage To Albert <b>...</b>

NFL Training Camp News: MRI Shows No Damage To Albert Haynesworth's Knee.

Introducing the CNET <b>News</b> iPhone app | Digital Media - CNET <b>News</b>

We know you've been clamoring for an official CNET News iPhone app, and we're happy to let you know it's finally here. Read all about what it does and why you should download it. Read this blog post by Josh Lowensohn on Digital Media.

big white booty

No comments:

Post a Comment